H

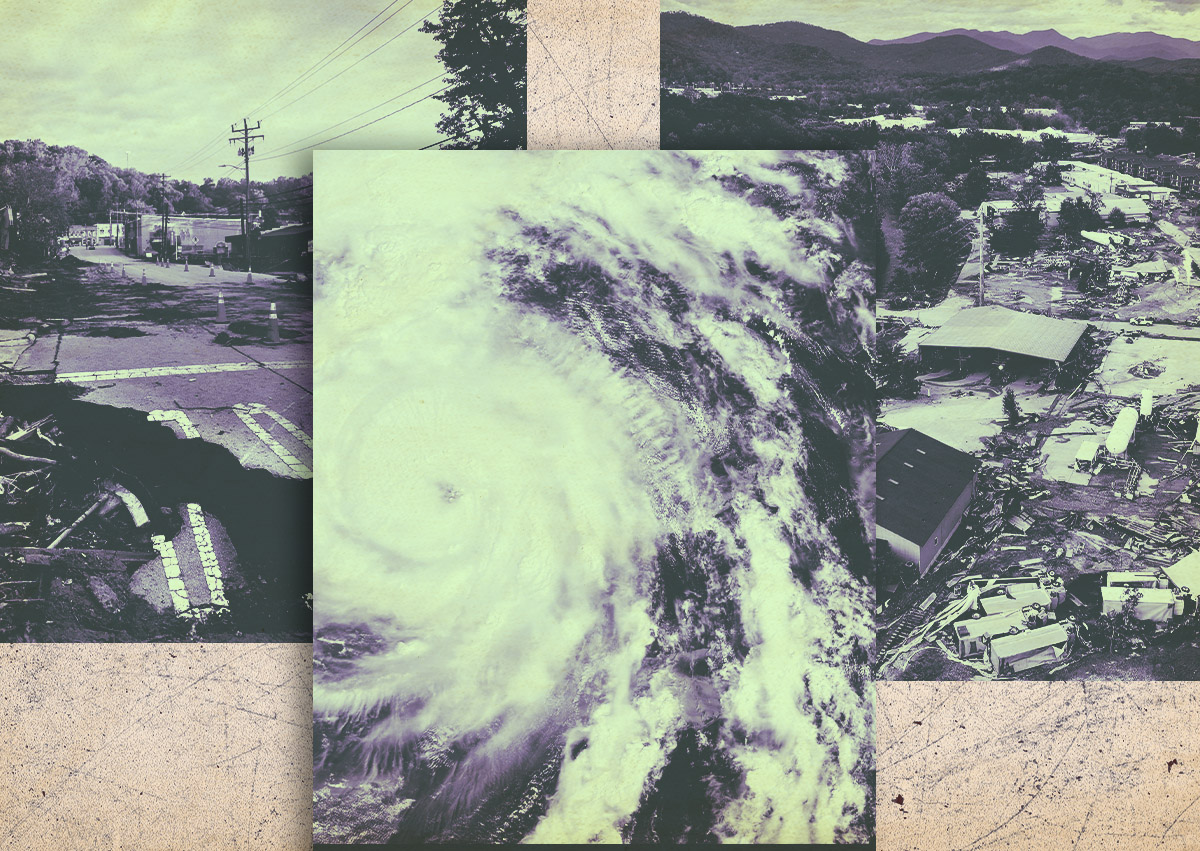

omeowners in Florida who suffered damage from Hurricane Helene may find their insurance claims denied or reduced due to tightened coverage by insurance companies. After natural disasters, insurers often add exclusions and provisions to limit payouts, the Wall Street Journal reported. Many property owners lack flood insurance, which is not typically covered under standard policies, with fewer than one in 100 homeowners in high-risk areas holding separate flood coverage.

High deductibles for wind-related losses can also leave claimants with no payout, while insurers may dispute claims by attributing damage to flooding rather than other factors like wind. This can lead to lengthy legal battles. In Florida, 50,000 Hurricane Ian claims remain unresolved two years after the storm, with nearly 40% of those claims still unpaid.

Hurricane Helene's estimated $15 billion to $26 billion in property damage is expected to result in insured losses ranging from $5 billion to $15 billion, according to Lloyd's of London CEO John Neal. Insurers' efforts to limit payouts may exacerbate the financial burden on affected homeowners.