I

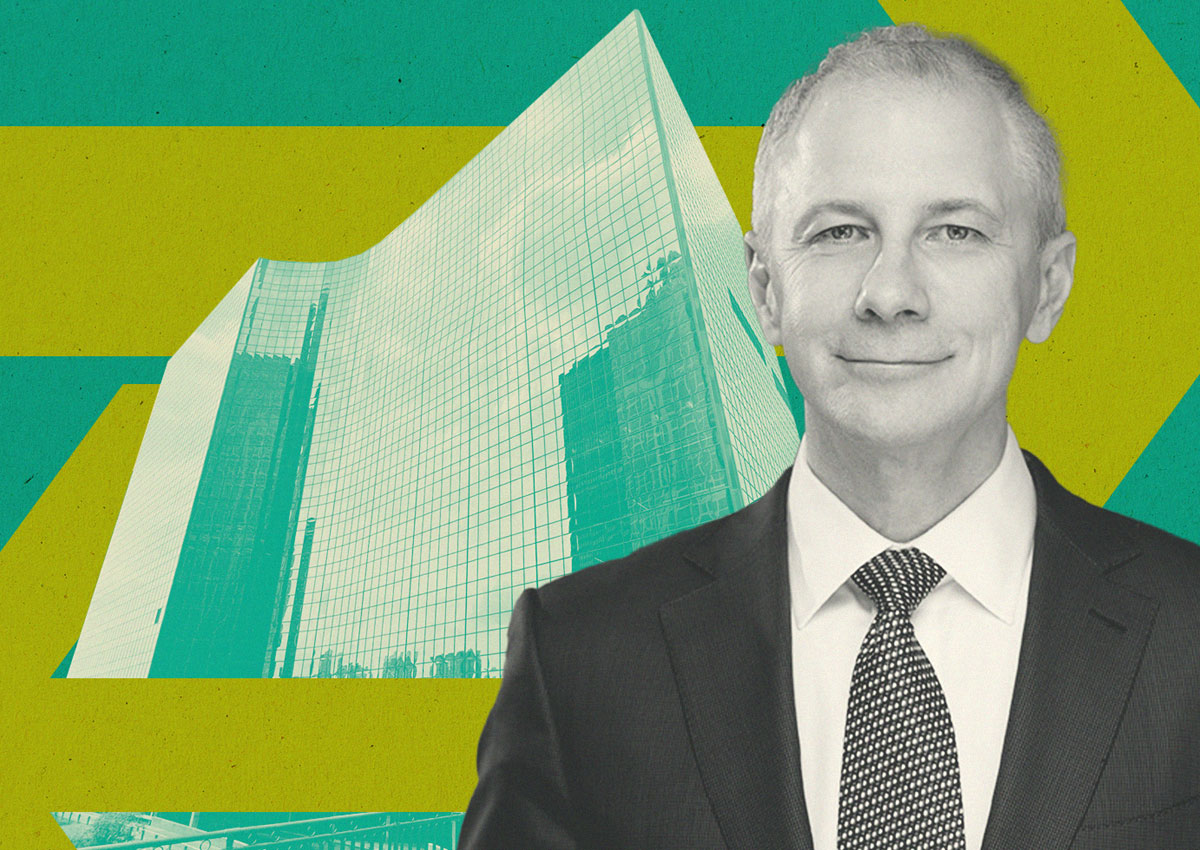

nteractive Brokers Group is planning a move from Chicago's historic LaSalle Street to a more modern workspace along the Chicago River. The electronic trading firm, led by president and CEO Milan Galik, is in advanced talks to lease nearly 55,000 square feet at 300 South Riverside Plaza, a 23-story building owned by Florida-based Third Millennium Group. CBRE's Mark Cassata and Bill Sheeh are representing Interactive Brokers in the negotiations.

The potential deal would consolidate the company's local operations, currently spread across two buildings, into one location. This move aligns with the trend of companies downsizing their office spaces as remote work becomes more prominent. With businesses rethinking large footprints and seeking modern amenities, older properties on LaSalle Street are seeing tenants migrate to newer buildings.

Interactive Brokers' departure from LaSalle Street poses a challenge for Bankhaus Metzler, which owns the historic 209 South LaSalle Street building known as The Rookery. With demand for vintage office space dwindling, Metzler faces the task of finding new tenants in a market favoring modern amenities. Despite its significant place in Chicago's architectural history, The Rookery is currently 91 percent leased, but Interactive Brokers' departure will leave a notable gap.

As a publicly traded company with $4.3 billion in revenue in 2022 and over 2,900 employees, Interactive Brokers' decision to reduce its Chicago office footprint reflects broader trends in the financial sector.