T

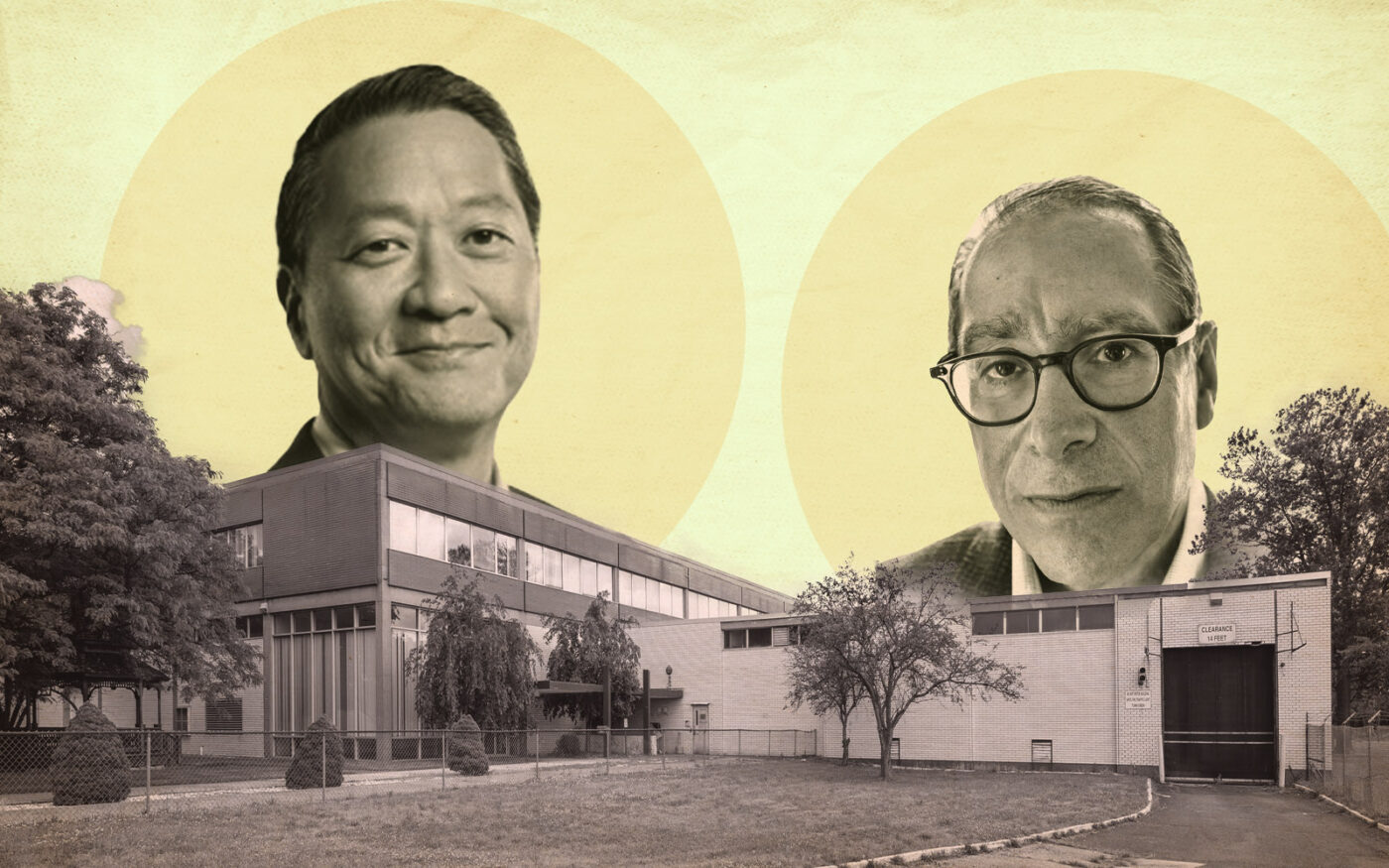

he industrial market may not be as hot as it was a few years ago, but deals are still happening. A notable example is the recent sale of a 283,000-square-foot distribution warehouse in Northeast Philadelphia to an affiliate of global investment giant KKR. The property, located at 9801 Blue Grass Road, was sold by DH Property Holdings for $83.5 million, or approximately $295 per square foot.

The warehouse, which features 54-foot clear heights and close access to I-95, is fully leased to TJX Companies, the parent company of discount clothing retailer TJ Maxx. DH Property Holdings completed construction on the property two years ago after purchasing the 21-acre site for $10.5 million. The firm received a $62 million construction loan from PCCP.

KKR's acquisition of the warehouse is part of its broader investment strategy in Philadelphia, which includes both multifamily and industrial real estate. In 2020, KKR set a record for the largest multifamily sale in the city with its purchase of the Philadelphia City complex for $357 million. The firm has also been active in the office market, buying three warehouses over the summer as part of a larger deal.

DH Property Holdings is led by Dov Hertz, a well-known player in New York real estate and a leading land assembler. Hertz founded his company in 2016 with a focus on industrial properties and has since developed several notable projects, including a 1.3 million-square-foot warehouse in Brooklyn's Sunset Park that he sold for $248 million this year.