C

ushman & Wakefield has released a groundbreaking climate risk data set for logistics and industrial (L&I) assets, empowering investors to make informed decisions about resilience across 7,300+ global buildings. The comprehensive dataset provides unparalleled insights into physical climate hazards such as flooding, heat, wildfires, and wind, which are reshaping the long-term value of industrial assets.

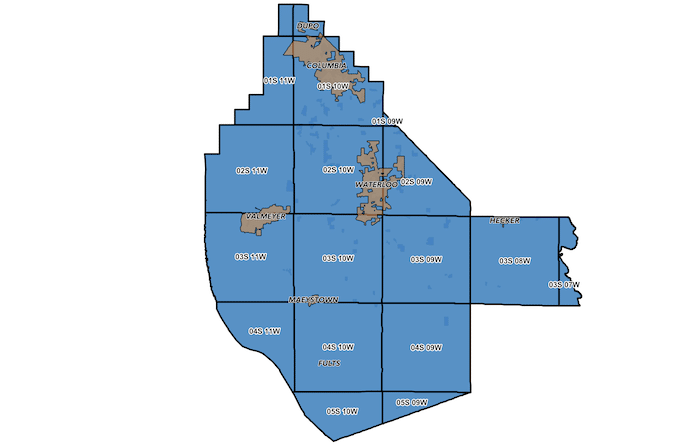

Historically, climate exposure has been overlooked in L&I transactions, despite a 43% growth in investment activity over the past decade. This new data enables investors to quantify, compare, and respond to risk at the asset level, with hazard scores mapped by submarket and individual site. The report reveals stark contrasts within regions, such as Chicago's varying flood risks and Asia's projected severe heat conditions by 2050.

"Climate risk is now quantifiable and actionable," says Jessica Francisco, Chief Sustainability Officer at Cushman & Wakefield. "Our new Logistics & Industrial (L&I) Climate Risk Outlook is a game-changer for clients seeking to integrate climate resilience into investment and operational strategy."

Cushman & Wakefield is also aligning its operations with global climate goals, including reducing absolute Scope 1 and 2 GHG emissions by 50% across corporate offices and operations by 2030. The company aims to deliver comprehensive sustainability support across the property lifecycle through its B2B model, which includes renewable energy sourcing, sustainable workplace design, and operational benchmarking.

The report connects risk exposure to business metrics such as operating costs, capital expenditure, leaseability, and portfolio value, enabling clients to reduce exposure, protect value, and align with evolving regulatory frameworks. By embedding climate data into investment decisions and long-term asset planning, Cushman & Wakefield hopes to support clients in achieving their sustainability goals.