N

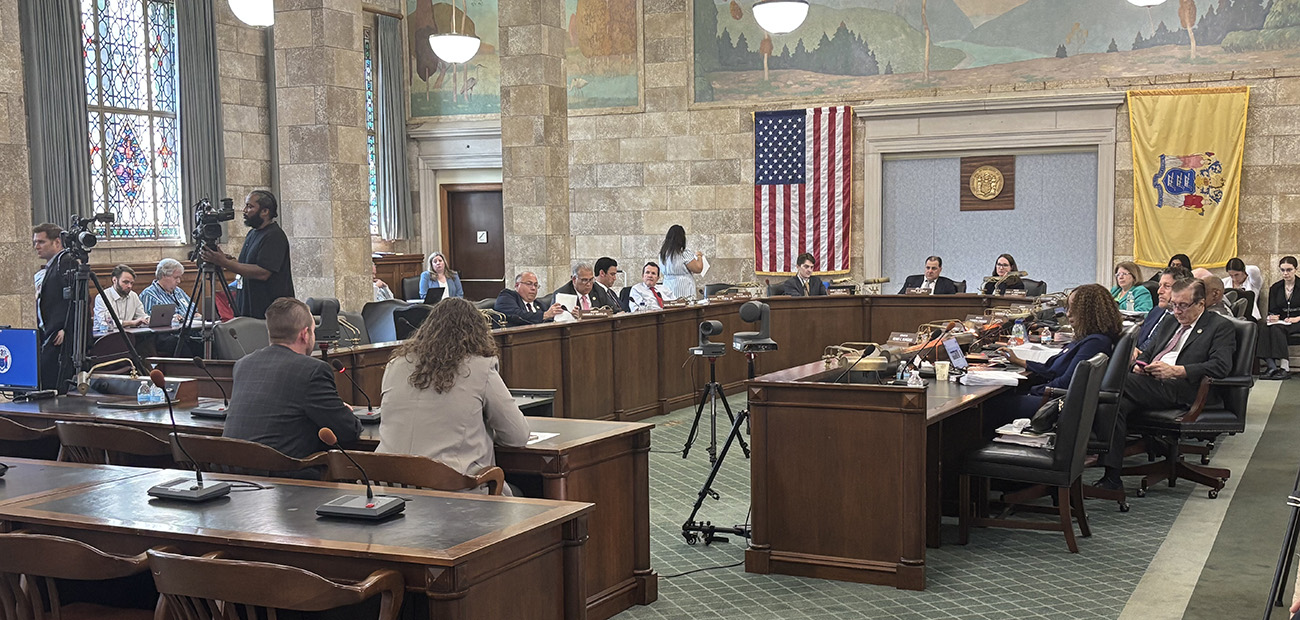

J REALTORS staff testified at a 2025 hearing on the impact of raising New Jersey's "mansion tax," which has been in place since 2004 for homes sold above $1 million. The fee scales up based on sales price, but as property values rise, the term "mansion" is becoming less accurate, says NJ REALTORS CEO Douglas Tomson. Many young families are priced out of buying and staying in their communities due to the added costs.

When Governor Phil Murphy proposed increasing the tax in his 2026 budget plan, NJ REALTORS immediately opposed it, citing research that nearly 20% of homes sold would be impacted. The association launched a campaign using funding from the National Association of REALTORS and internal resources to supplement direct advocacy efforts with elected officials.

NJ REALTORS concentrated on securing meetings with key officials and launching a call-to-action campaign over four months. They secured a meeting between state officials and NAR economists just before the budget deadline, which helped reshape the governor's view of the proposed transfer fee. The data shared by NAR economists showed national and state-level home-buying trends that influenced the changes.

NJ REALTORS' advocacy led to significant adjustments to the transfer fee proposal. The projected revenue for fiscal year 2026 was revised upward, with the state expecting over $550 million in additional revenue. The final proposal will cover an estimated 2% of sales, up from the initial 20%, due to adjusting the increased fee up to the $2 million price point. Shifting the burden of the fee from the buyer to the seller is also seen as a win for affordability-challenged buyers.

NJ REALTORS Director of Government Affairs Catherine Best notes that removing this transfer fee will be the difference between being able to afford a certain home or not for many first-time homebuyers. The association's efforts on this issue were successful due in part to their positive reputation and the REALTOR brand.