T

he real estate brokerage industry has faced significant challenges in recent years, including high mortgage rates, low inventory, and stagnant demand. The Trump administration's tariff policy has added to these difficulties.

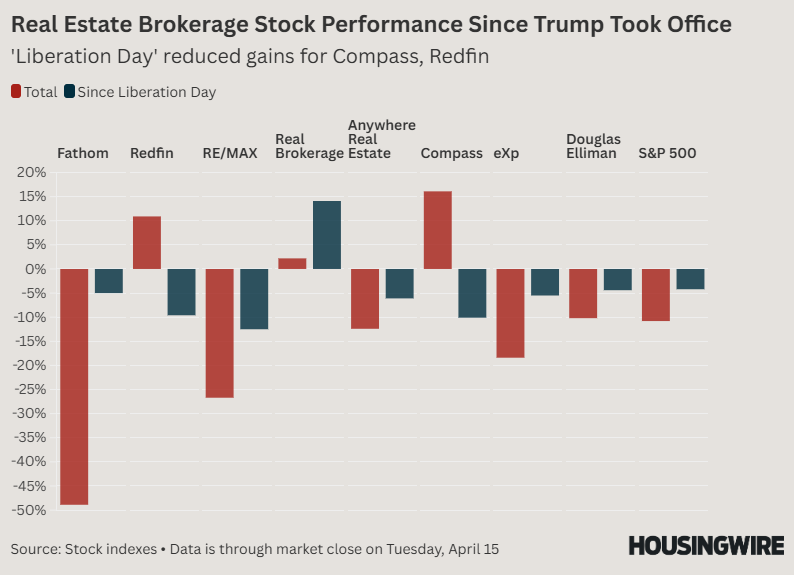

The sudden implementation of new global tariffs sparked a market upheaval that affected the stock market, currency exchange rates, and bond markets. Brokerage stocks were also impacted, with major equities underperforming the S&P 500 since April 2, when President Trump announced his "Liberation Day" tariff rollout. Only The Real Brokerage has seen an increase in value over this period.

Among the nine companies analyzed by HousingWire, only three have outperformed since Trump's second term began: Redfin (up 10.9%), Compass (up 16.1%), and Real (up 2.2%). However, these gains come with caveats. Compass saw a significant jump in February after its fourth-quarter earnings call, while Redfin's stock fell following subpar earnings but recovered after an acquisition announcement.

The decline in consumer confidence following the tariff implementation may also impact homebuyers' decisions to pause their searches until the situation becomes clearer. Some sellers are taking proactive steps by listing their properties ahead of potential long-term fallout from the tariffs. Brokerage stocks have taken a hit, while homebuilder equities have fared even worse, with seven out of nine companies analyzed experiencing declines of over 15% since Trump's inauguration.