S

ears is struggling to stay afloat and has enlisted the help of Huron Consulting Group to negotiate rent concessions with its remaining landlords, according to Bloomberg. The company's plea for leniency comes as it faces an uncertain future, having liquidated many of its stores in recent years.

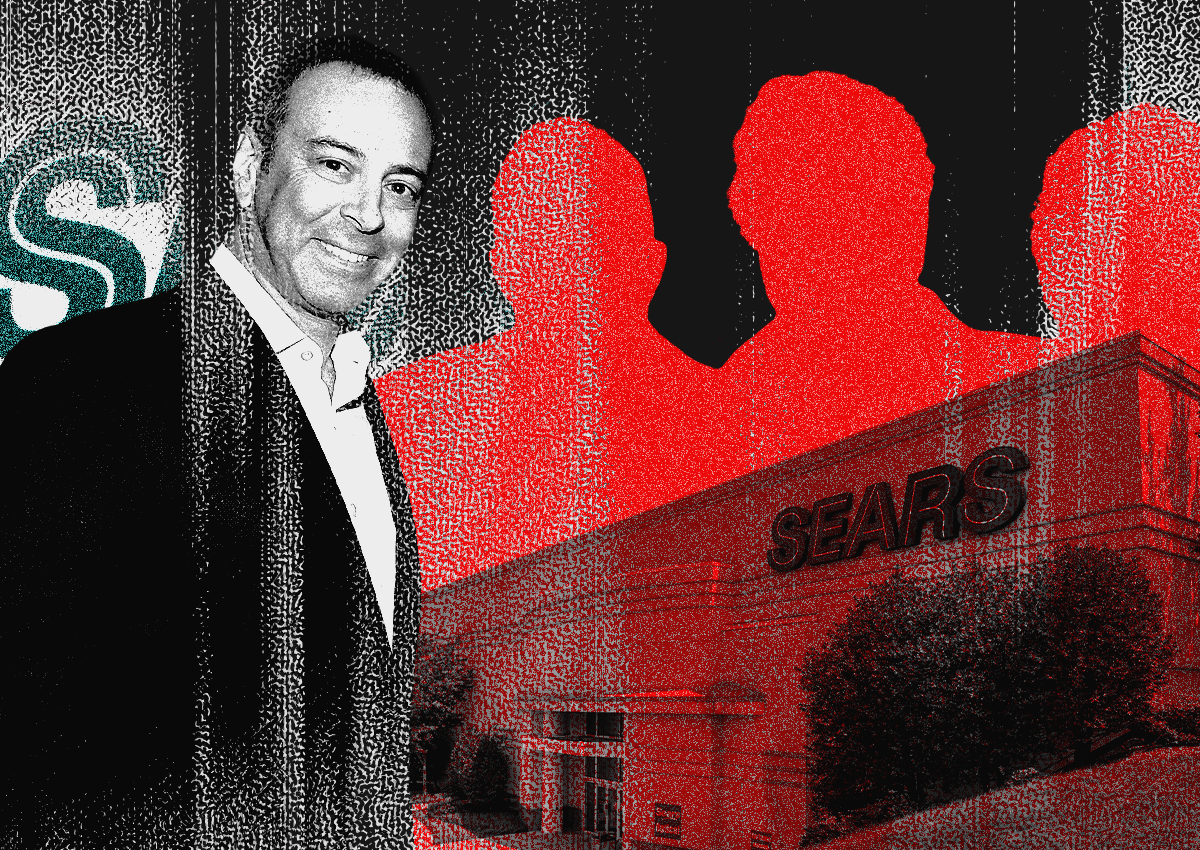

As a subsidiary of Eddie Lampert's Transformco, Sears is in dire straits. At its peak over a decade ago, the retailer had around 4,000 stores worldwide, but today only 11 locations remain operational in the US, including one on Puerto Rico. The company has been on the brink of collapse for years, with its demise seemingly inevitable.

Sears' troubles began when Lampert-led Kmart Holding purchased it in 2005 for $11 billion. In 2019, Sears sold its stores to ESL Investments, Transformco's parent company and a Lampert affiliate, for $5.2 billion. The following year, Sears filed for bankruptcy with 687 stores still operational, but exited four years later with just 15 remaining.

Transformco subsidiary Seritage Growth Properties has also been struggling to turn the remnants of Sears into a viable business or sell its assets. Despite retaining Barclays to find a buyer, no offers were received, and shareholders ultimately approved a plan to liquidate the company's properties and return proceeds to investors. Another Transformco subsidiary, Kmart, is set to close its last full-sized store in the Hamptons within two weeks, leaving only a small location in Miami as the last remaining mainland store.