A

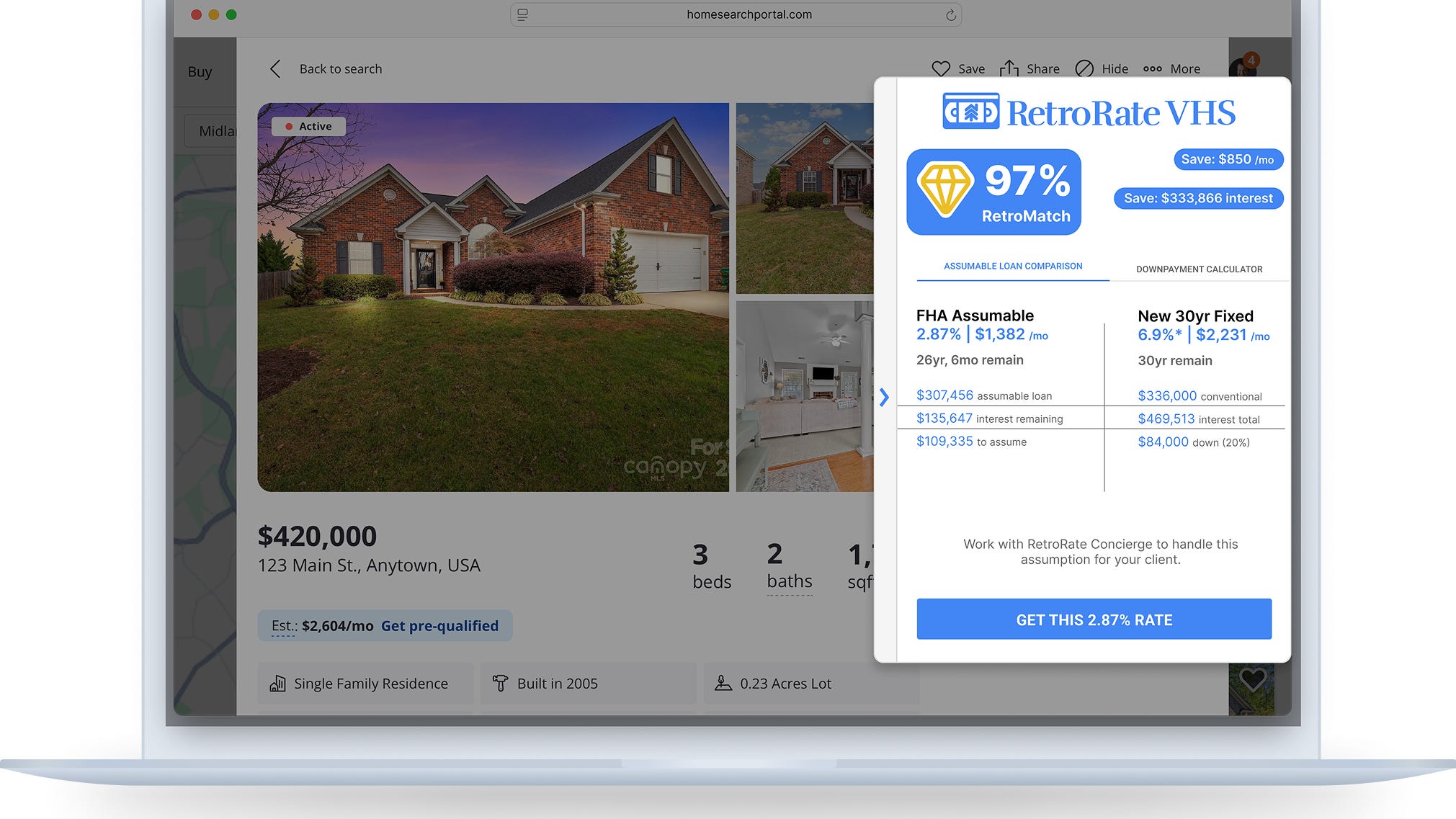

typical American homeowner who sells their home and takes out a new mortgage can expect to pay around $2,700 per month. However, if they purchased the home at a low interest rate of 2-3% or refinanced during that period, their monthly payment could be as much as $1,000 less. A company called RetroRate offers a software tool that helps buyers find homes with assumable mortgages - those that can be taken over by the new owner.

Assumable mortgages are typically guaranteed by government agencies like the VA or FHA, and some Fannie Mae and Freddie Mac loans. These types of loans can save buyers an average of $1,037 per month in interest payments. However, there are drawbacks to assumable mortgages - they can take time to process, as the existing mortgage servicer is responsible for transitioning the loan to the new buyer.

RetroRate offers a concierge service that helps buyers and sellers navigate the assumption process for a fee equal to 1% of the purchase price. The company's founder, Andy Taylor, believes that assumable mortgages can be a game-changer for buyers, but also notes that they may require a longer processing time than traditional mortgages.

One key challenge with assumable mortgages is that they are often smaller than the current market value of the home. For example, if a buyer purchases a $500,000 home using a $450,000 mortgage, there may be a significant equity gap - in this case, $400,000 - that needs to be covered by the buyer or through additional financing.

Real estate agents and industry experts are divided on the benefits of assumable mortgages. Some, like Evan Tando, believe they can help both buyers and sellers, while others, like Andi DeFelice, note that the equity gap may make them less appealing to some buyers. Despite these challenges, RetroRate's tool is seen as a valuable resource for homebuyers looking to save on interest payments.