C

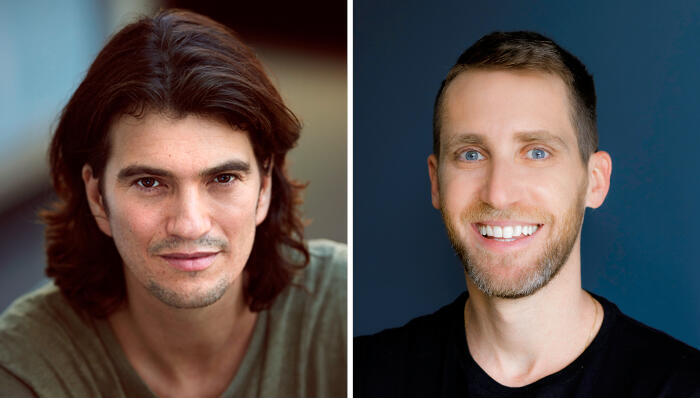

anada Global, a real estate company controlled by Assaf Tuchmair and Barak Rosen, has secured a significant investment from Adam Neumann's Flow, Andreessen Horowitz, and Wiz co-founder Assaf Rappaport. The deal, announced on Sunday, saw Canada Global shares surge 54% as the company received NIS 98.8 million ($27M) in funding. Flow will hold 29% of Canada Global after purchasing 25% of its equity at a premium price and an additional 4% from other shareholders.

The investment values Canada Global at NIS 252 million, a significant increase from its pre-deal valuation of NIS 167 million. Tuchmair and Rosen's combined holding will drop to 58.7%, while their shares will be valued at NIS 200 million, generating a paper profit of NIS 190 million.

Canada Global plans to focus on real estate outside Israel, except in countries where its partner Israel Canada is active. The company aims to develop and operate rental housing projects in the Miami market, targeting deals worth $100 million or more per transaction. Flow will have the right to enter as a partner in up to 50% of each project initiated by Canada Global.

The investment marks Andreessen Horowitz's first foray into an Israeli public company. Neumann's Flow has raised significant funds since its inception, including $350 million from Andreessen Horowitz at a valuation of $1.7 billion. The deal is seen as a comeback for Neumann after being ousted from WeWork in 2019.

Canada Global will concentrate on developing and operating rental housing projects, which will then be managed by Flow. Each project will consist of hundreds of apartments, with the first deal expected to close in the coming weeks.