Avoiding Real Estate Scams in the Modern Market

Stay ahead of real estate scams: learn to recognize and prevent the latest threats.

Ryan Serhant's Leap into Commercial Real Estate: Sales and Marketing Insights

Million Dollar Listing" star trades buildings with tech and social media savvy.

Establishing Client Loyalty in Real Estate through Expert Guidance

Building Trust in Real Estate: A Conversation with Christina Wright and Greg Lafferty on Straight Outta Crumpton.

US Social Network Homz.io Shuts Down Amid Real Estate Developer Backlash

Homz.io, a leading Canadian web portal for new housing, ends social media presence due to limited effectiveness and ethical concerns.

Lebanon County Property Transactions: March 1-15

Lebanon County Real Estate Transfers: First Half of March

Trump's Visa Program May Fuel Commercial Real Estate Growth

A potential shift in US tax policy could reduce demand for foreign investment through the EB-5 program.

Boom in Cape May, NJ Real Estate Markets and Cannabis News

Get the latest NJ news in a quick audio update.

West Bend Shoppe Custard & Grill Installs New Signage

West Bend's The Shoppe Custard & Grill Installs New Signage

Portugal's housing market to see sustained price growth due to supply-demand imbalance

Wealthy Americans seek sunny Portugal for lower living costs.

Simon Property Group shuts malls amid retail struggles

Simon Property Group, largest US mall owner, faces challenges due to retail store closures.

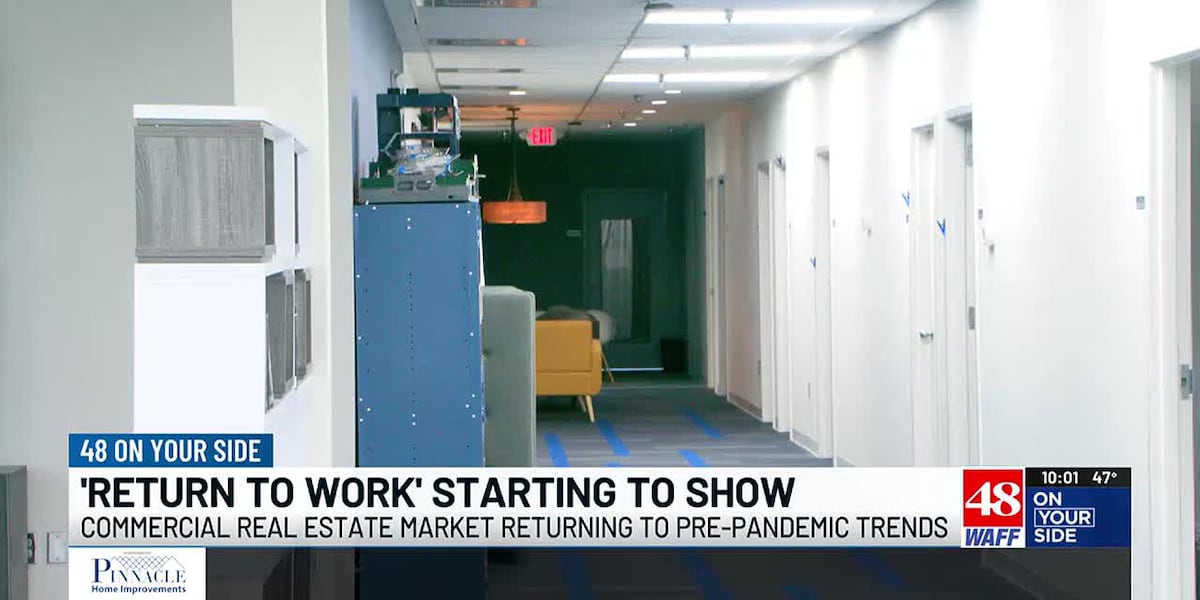

Huntsville corporate real estate market regains pre-pandemic momentum

Corporate real estate market shifts back to pre-pandemic levels as workers return from remote work.

Blackstone Secures $8 Billion for New Real Estate Debt Investment Fund

Blackstone Closes BREDS V with $8 Billion in Total Capital Commitments.

ABI-LAB Expands to Natick with Third Bio-Incubator Facility

ABI-LAB Expands to Natick, MA with Third Facility, Bringing Total Space to 112,000 SF.

CarneyKelehan Welcomes Rachel Hess as Real Estate Law Expert

Rachel M. Hess Joins CarneyKelehan, a Columbia-based law firm with over 40 years of experience in her field.

DOJ expresses ongoing dissatisfaction with Nosalek settlement terms

Federal agency reiterates stance on 5-year-old case, calling proposed revisions "cosmetic".

CalSTRS Allocates $1.2 Billion to Real Estate Investments

Targeting underrepresented sectors: data centres and self-storage with two key commitments

Louisiana Teachers Pension Fund commits $250m to Oaktree Real Estate Partnership

Pension fund invests in North America open-ended core-plus real estate vehicle.

Hudson's Bay: How Real Estate Expertise Fails to Salvage a Struggling Retailer

Baker's success as Hudson's Bay Co. governor was in extracting cash, but failed to retain shoppers

Local officials discuss real estate assessment appeal process

Roanoke City Council gets update on reassessment appeals process.

Weekly Real Estate Activity Report: March 3-7

Rhode Island Real Estate Transactions from March 3-7 Sponsored by Hogan Associates