M

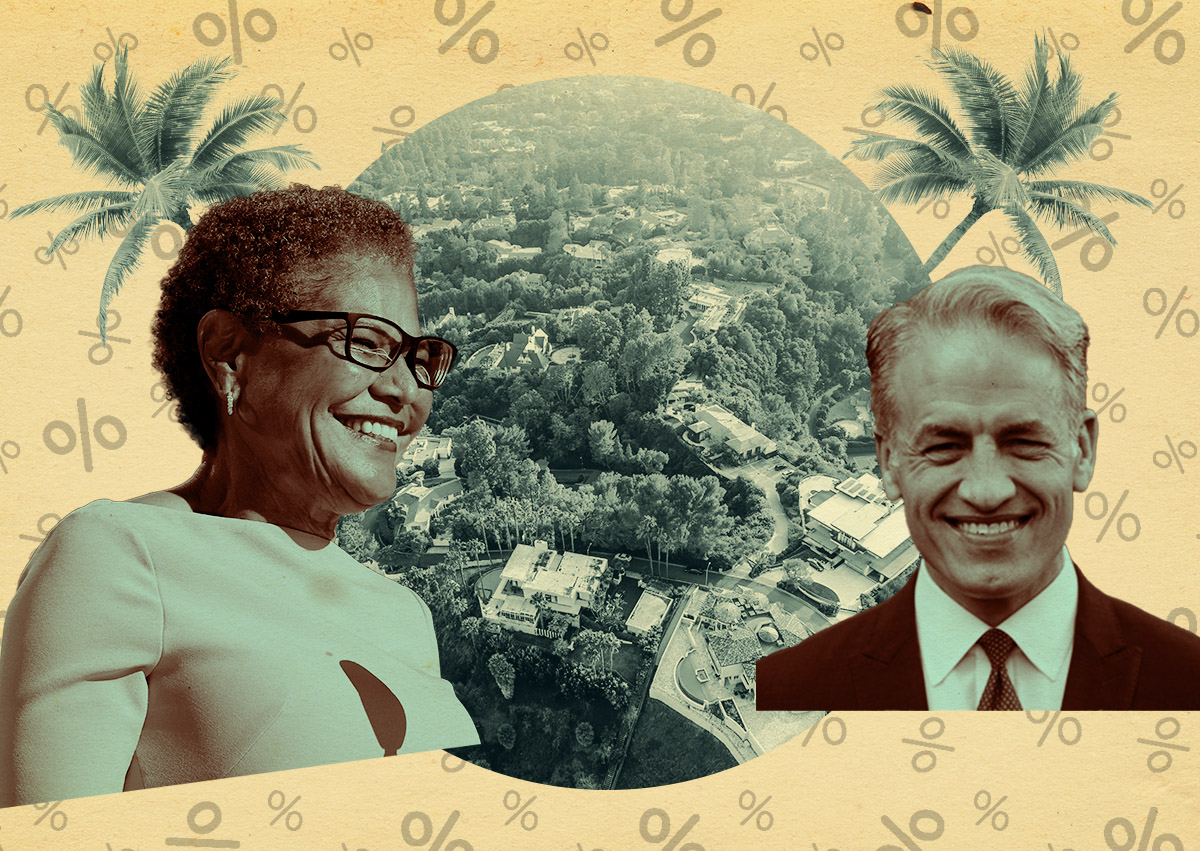

easure ULA, Los Angeles' mansion tax, was expected to generate up to $1.1 billion annually but has fallen short of projections. In 18 months, it has collected less than half that amount, primarily from West L.A. sales. The voter-approved real estate transfer tax has raised $439 million from 670 transactions as of October 31, according to the Los Angeles Times.

The tax charges a 4% fee on residential and commercial property sales above $5.1 million and 5.5% on sales above $10.3 million. Original projections estimated between $600 million and $1.1 billion annually, but actual collections have ranged from 27% to 60% below expectations.

Mansions account for 57% of properties affected by the tax, with commercial properties making up 20% and multifamily complexes 10%. Westside neighborhoods have driven nearly half of all mansion tax sales. Districts 5, 11, and 4 have reported significant revenue from the tax, with totals of $83.3 million, $73.9 million, and $59.4 million respectively.

The Los Angeles Housing Department has released figures on the ULA Emergency Renters Assistance Program, which has received 31,380 applications and paid out $30.4 million to 4,302 households. The program's dashboard provides a detailed look at its performance. A challenge to Measure ULA by real estate interests is pending before the U.S. Court of Appeals for the Ninth Circuit.