A

recent study by WalletHub has revealed the states with the lowest and highest real-estate taxes in the US. The average American household spends around $2,969 on property taxes annually, highlighting the importance of considering these costs when deciding where to live.

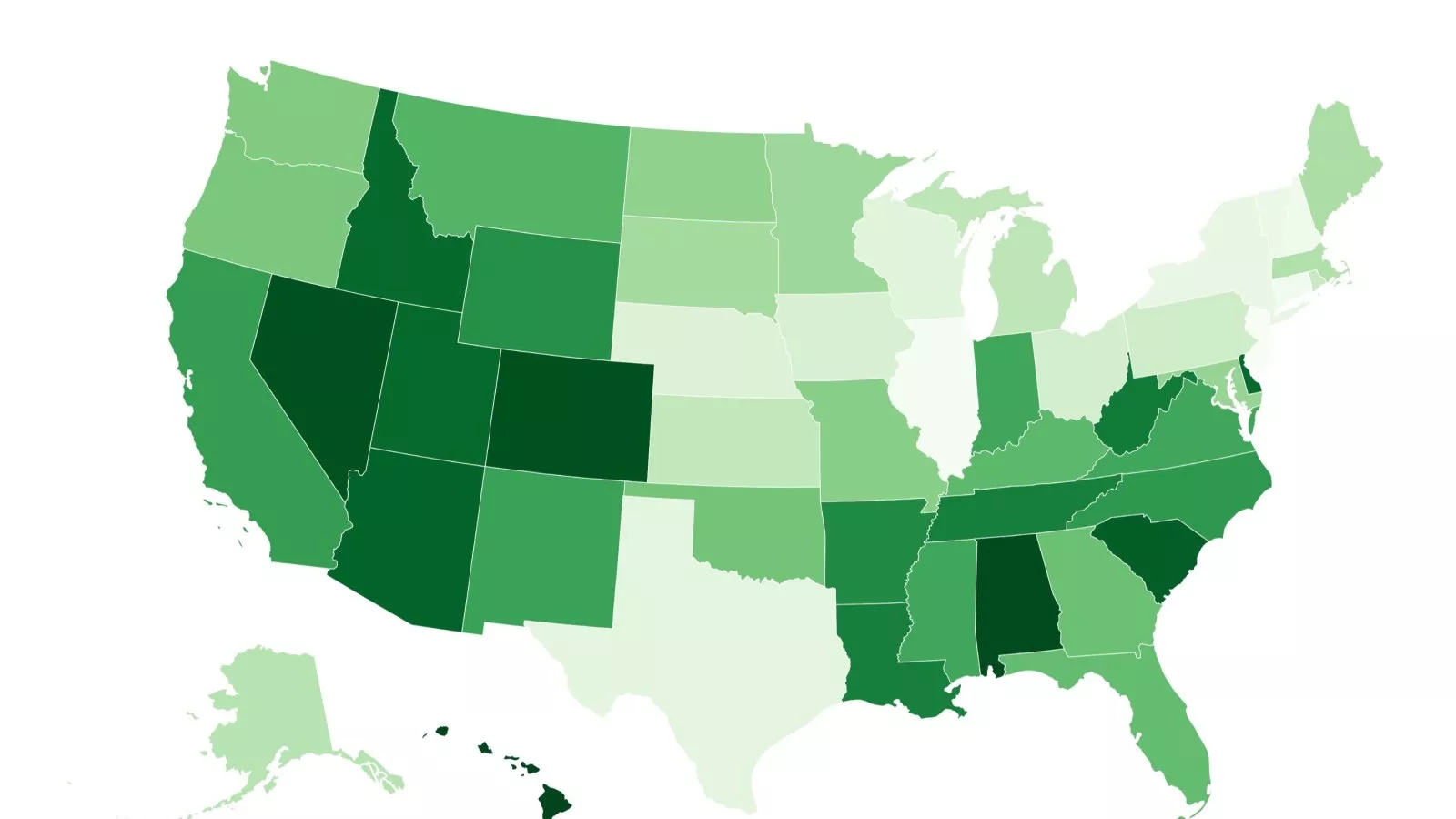

To determine the rankings, WalletHub analyzed data from the U.S. Census Bureau, comparing property tax rates across all 50 states and Washington D.C. The study found that Hawaii has the lowest effective tax rate at 0.27%, with annual taxes on a $303,400 home totaling just $820. Alabama came in second, followed by Nevada and Colorado.

On the other end of the spectrum, New Jersey had the highest effective tax rate at 2.23%, with residents paying $6,770 annually on a $304,400 home. Other states with high property taxes include Illinois, Connecticut, and New York.

WalletHub analyst Chip Lupo noted that property taxes can have a significant impact on an individual's finances, and should be taken into account when deciding where to live. Valrie Chambers, a research fellow at Stetson University, added that while people may not directly consider property taxes when moving, they often indirectly factor them in through the overall cost of living.

The report highlights the importance of considering multiple factors when evaluating the affordability of a state or region. For example, while Florida's property taxes are lower than California's, insurance costs can be higher, making the two states more comparable in terms of overall housing costs.